What does your credit score need to be to buy a house for the first-timer? A lot of people want to know if they can apply for a mortgage or not.

In this article, we will have a discussion about credit scores and how they’re the VIP pass to your home-buying plans. Credit score definition, factors that affect credit score, and ways to improve your credit score are all in this guide.

What is a Credit Score?

A credit score is your banking transactions and credit history, which includes information like the number accounts, total levels of debt, repayment history, and other factors.

Your credit score is a very important factor in mortgage loans. Whether good or bad, it will influence your loan application. But how can poor Credit Score hurt your Social Security benefits? Does it have effects on your borrowing limit? I have already explained that in my previous guide on Bad Credit Score. If you have a good credit score, lenders might just line up to offer you better mortgage rates. It’s like having complete documents of the homeownership requirements.

What credit score is needed to buy a house with no money for down payment? The short answer is 620 and above. While to buy a car, a target credit score of 661 or above should get you a new-car loan with an annual percentage rate of around 6.40% or better. However, you don’t need a perfect credit score to get your dream home. Yes, you heard it right. The minimum credit score you need can differ, depending on which lender you’re talking to and the specific type of loan you’re after.

So, while one lender might want to see a certain minimum credit score, another might set the bar a tad higher or lower. It’s like trying on different suits to find the one that fits just right.

Make sure you remember that, your credit score is your financial strength, but it doesn’t have to be very high to open doors to homeownership. It’s all about finding the lender and loan type that groove with your score. So, as you begin your home-buying search, just remember – your credit score is your power, helping you make those mortgage moves.

Take Away

- First of, the minimum credit score that you’ll need to buy a house varies by lender and loan type.

- Secondly, you’ll typically need a credit score of at least 620 for conventional loans.

- Thirdly, to qualify for the best interest rates on a mortgage, aim for a credit score of at least 740.

What Credit Score is Needed to Buy a House?

There’s no one-size-fits-all credit score that can guarantee you a direct mortgage approval. Nope, each lender out there gets to play by their own rules and set their own credit score requirements.

There are different “loan types”. Different type of loan opens doors to your dream home. Some loans have insurance protection, and it’s provided by government agencies. And guess what? When it’s government-backed, lenders have to play by certain rules, especially when it comes to credit scores.

- Conventional Loans Minimum credit score is 620

- FHA Loan Minimum credit score is 580

- VA loan Minimum credit score: No minimum score

- USDA Loans has not minimum credit score

The Four (4) most popular Home Loan types:

Conventional Loans:

These are very flexible in the mortgage industry, where lenders have a bit more freedom in setting their credit score bar. It is not backed by any government agency, but must meet the Fannie Mae and Freddie Mac underwriting guidelines. It is divided to conforming loan and non-conforming loan. Conventional Loans Minimum credit score is 620 only.

FHA Loans:

This type of loan is backed by the Federal Housing Administration. They are for people with credit scores as low as 580. It’s like the FHA giving you a little opportunity for your homeownership. Minimum credit score: 580 for a 3.5% down payment; 500 for down payments of at least 10%

VA Loans:

To our military heroes, this one’s for you. It is a government-backed loan. The Veterans Affairs loans minimum credit score focus more on your overall financial health. Minimum credit score: No minimum

USDA Loans:

These are like the hidden treasures for rural and suburban homeownership, with credit scores often starting at 640. Minimum credit score: No minimum, but with a credit score of at least 640 you could qualify for streamlined credit analysis.

Bottom Line

So, remember, while there’s no one specific credit score for all lenders, different loan types come with their own credit score. When it comes to minimum credit score requirements, lenders has the final say. Some might follow the minimums set by loan-backing organizations, while others might roll out their own red carpet with higher requirements. It’s like a puzzle – each piece fits differently, and it’s up to you to find the perfect match with a lender and loan type that suits your financial budget.

What is a good credit score for buying a house?

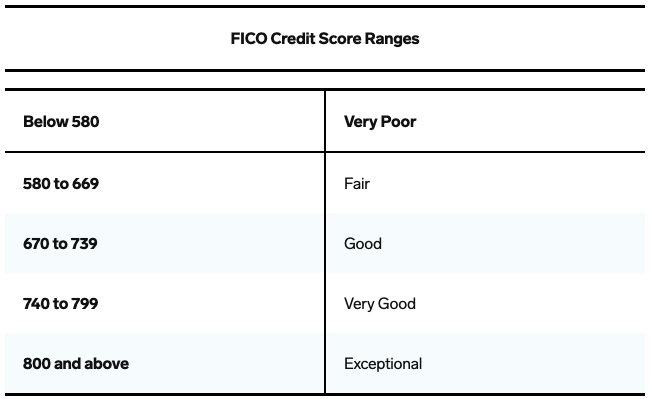

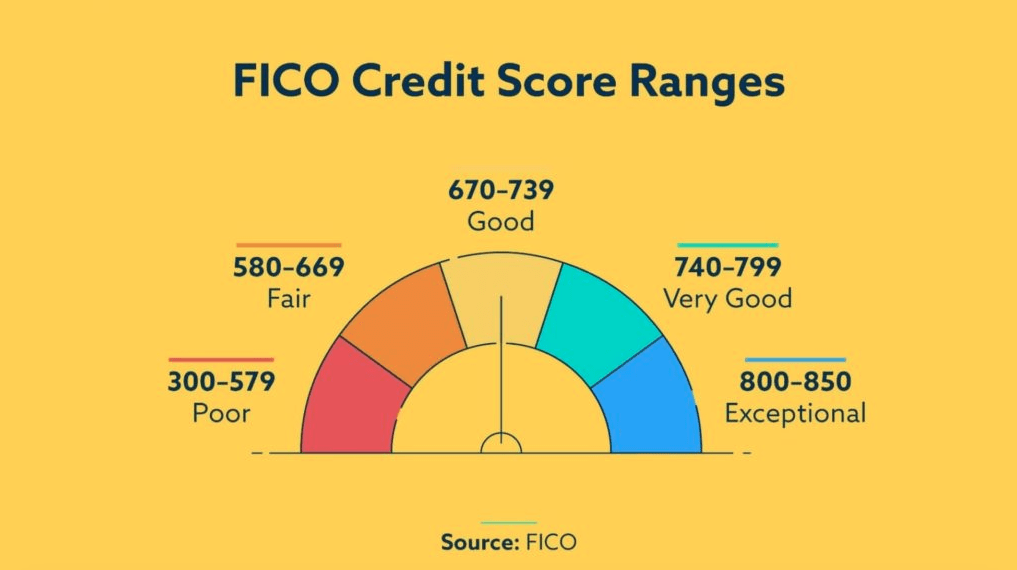

From the discussion above, we’ve talked about the minimum credit score ranges and how they influence your mortgage projects. FICO, is the the Fair Isaac Corporation of credit score and they have a way of categorizing scores. There are five different credit score ranges, each with its own possibilities:

Related: What is FICO score and Why is it Higher than Credit Score in Finance?

FICO Credit Score Ranges

- Exceptional (800-850): This is like being the star student of the credit score class. With a score in this range, you’re waving the flag of financial excellence, and lenders might roll out the red carpet for you. Expect those enticingly low mortgage rates and open doors to some of the best deals in town.

- Very Good (740-799): You’re still in the A-team here. With this score, you’re likely to enjoy some sweet mortgage rates and a smooth journey through the application process.

- Good (670-739): It’s like being in the solid B range – good job! Lenders are still likely to offer you reasonable rates, so you’re in a good position to make those homeownership dreams come true.

- Fair (580-669): Alright, we’re getting into the B-minus zone. Lenders might raise an eyebrow, but don’t worry, you’ve still got a shot at decent rates. It might be worth shopping around a bit to find a lender who believes in your potential.

- Poor (300-579): This is like the cramming-before-the-test situation. A score in this range might raise some flags for lenders, and you might encounter higher interest rates or stricter terms. But don’t lose heart – there are still options out there.

Striving to land your credit score within the “Good” range (670 to 739) is a solid step toward mortgage eligibility. However, if you’re gunning for those best rates, aiming for the “Very Good” range (740 to 799) would be even better.

Related: How to Improve Your Credit Score.

Improving your credit score from 500 to 800 requires serious dedication and personal interest. Meanwhile, you can review the difference between FICO Score and Credit Score in Loan Financing and Credit-worthiness.

KeyNote

Now, while your credit score is a key player, it’s not the only criteria in the mortgage application. Lenders have a upper decision to a whole performance called the underwriting process. So, even if your credit score is very high, other factors like your income, work history, and that tricky debt-to-income ratio can also influence the decision.

Notice that a list of factors needs to be considered for that mortgage approval to given by the lender. One of the factors is your debt level. You can learn from the 11 Ways to Quickly Get Out of Debt and Rebuild Your Credit Score from my previous article.

How Credit Scores affect Mortgage Interest Rates

Taking a look of credit scores and their role in shaping the financial landscape of your loan journey is vital. Your credit score has the power to influence the cost of your loan in a big way.

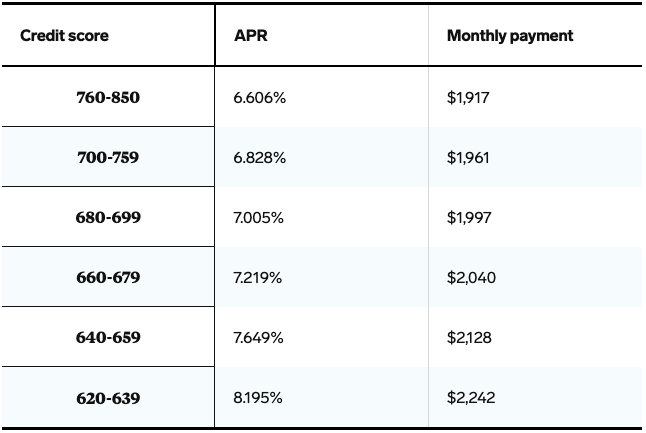

FICO, has data that gives a clear picture of how your credit score could influence with your interest rate and payments. Here’s a glimpse into what that dance looks like, with a spotlight on the monthly costs of a $300,000, 30-year fixed-rate mortgage as of July 31, 2023:

We can do some financial analysis to understand the numbers. From the data above, we have 1.6 percentage points difference and a monthly payment gap of $325. That’s like comparing the 620 to 639 credit score range to a luxurious apartment in the 760+ range.

But, you can use your mortgage calculators, because these differences aren’t just numbers on a page. They’re like little drops that create a financial ripple over time. According to Consumer Financial Protection Bureau (CFPB), a mortgage with a 5.25% interest rate could end up costing you $43,000 or more over 30 years compared to a mortgage of a 4.125% interest rate.

The links below has more information:

- Mortgage Calculator for Easy Debt Payoff with Formula

- How to Calculate Your Loan Payments with Mortgage Calculator

- Amortization Calculator – Schedule & Fixed Housing Interest Rates

- How Much is Mortgage Payments, Interest rate, Taxes and Insurance

How to Improve your Credit Score – Best Methods

Alright, let us unveil the secret for improving your credit score to new heights. (i) minimize your credit card usage (ii) do not apply for new credit (iii) pay your bills on time.

Where do you start from? Step one: figure out where you’re starting from. Step two: check your FICO score. Especially during the these economic tough times, you’ve got the opportunity to check your credit report for free not just once, but every week. The three major credit bureaus, TransUnion, Equifax, and Experian, are giving reports at AnnualCreditReport.com.

Be careful while viewing your report because if you see any errors while investigating your reports, you can challenge it. Make sure you dispute those inaccuracies with the credit bureau. While you’re at it, it is advisable to give the lender or credit card company a friendly notification.

In most cases, your bank or credit card issuer will tell you your credit score for free. But if they refuse to reveal it to you, then you can try other options. There are other credit bureaus like Credit Karma or Credit Sesame. These free credit score monitoring tool can be of help.

What can you do if you discover that your score needs improvement?

If you need improvement in your score, then follow these guidelines and use these free tools.

- Start by reducing the use of your credit card to reduce the balances downwards. It will help you save more to get the best credit score to buy house for your family.

- Avoid any credit application in the months before your mortgage quest. Keep it steady, and don’t rock the credit boat.

- Pay your bills on time, every time. This is your best move, the one that carries the most weight in the credit score issues. Consistent as well as on-time payments are the key to unlocking a future of financial greatness.

Conclusion

In summary, increase your salary, start business, take seasonal or side jobs and try to save more than spending. This is as far as we can go today on your credit score improvement journey. Follow them religiously and you will get the best credit score to buy house or car. From checking reports to solving errors, from balancing acts to timely bill payments.

Trust me, this is your guide to becoming the credit score master so that you can march confidently toward your mortgage dreams. Finally, the good news is you don’t need a perfect credit score to buy a house. Live life well and save more for your future.

Helpful Guides

- Best Strategies to Improve Your Credit Score from 500 to 800

- Credit Score Check, Reports and Highest Range in Your Finance

- How to Remove Repossession Report Out of Your Credit Report

- Repo: How Long Does a Repossession Affect Your Credit Score?

- Repossession Law and its Consequences on Your Credit Report

- Can I Get a Home or Car Loan with a Repossession on my Credit?

- Home Equity Lines of Credit (HELOCs) What it is and How to Access it

- What is Credit Facility? How it Works for Personal & Business Loan and Mortgage