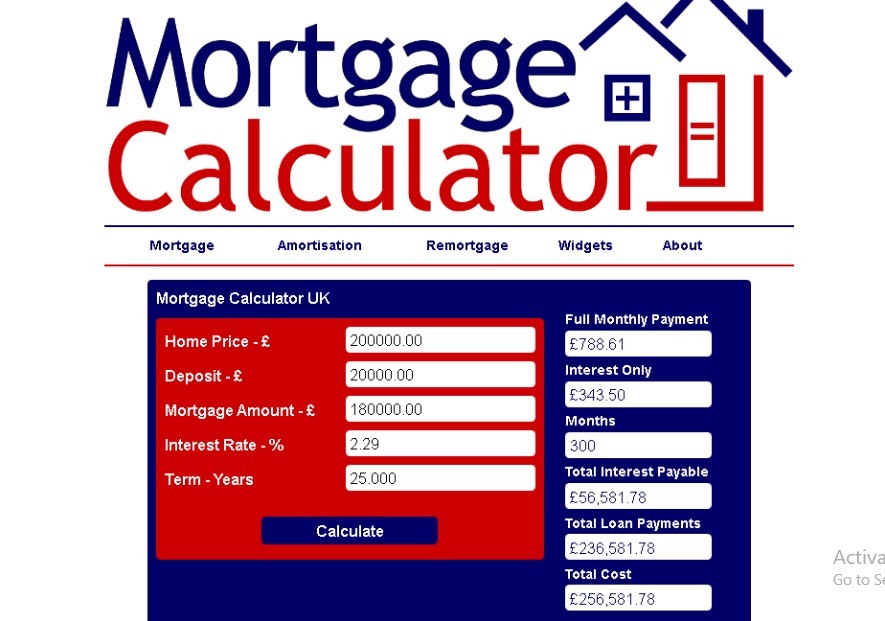

Mortgage Payment Calculator assist you to calculate your payment for free by estimating the monthly cost of houses for sale in your area. when you make the decision to buy a home, it’s important to determine the amount you can afford.

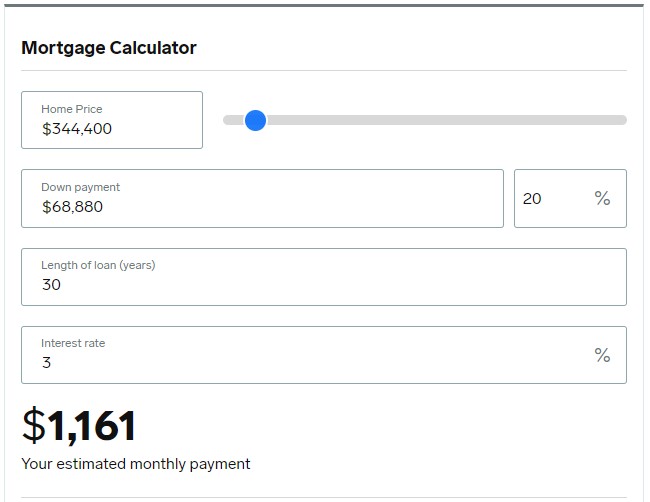

The Insider mortgage calculator for example is available at no cost and calculates your monthly payments based on factors like home price, down payment, loan term, and mortgage rate. Additionally, it offers personalized suggestions on how to save money on your mortgage.

How to use the mortgage payment calculator

To estimate your mortgage payment with our calculator, here’s what you’ll need to provide:

The purchase price of the home

The purchase price is the agreed-upon amount that you will pay to the seller for the property. This amount typically exceeds the total loan amount because it does not include any upfront payments you make toward the purchase.

Down payment

Many mortgages necessitate buyers to provide a down payment, which can vary depending on the loan type and credit score. It can be as low as 3% of the home’s purchase price. However, the calculator’s default is set at 20%, as this is the amount you would need to put down to avoid additional costs associated with private mortgage insurance.

Length of the loan

The loan term, or the duration it takes to fully repay your mortgage, significantly influences the cost and affordability of the loan. Longer-term loans offer lower monthly payments, but you end up paying more in total interest over the loan period. Conversely, shorter-term loans require higher monthly payments but result in lower overall interest costs. The calculator assumes a default loan term of 30 years.

The interest rate on your mortgage is the fee charged by your lender for borrowing the money to buy your home. A higher interest rate leads to higher monthly payments, while a lower interest rate results in lower monthly payments. By using the calculator, you can input these details to determine the affordability of a house, calculate monthly payments, and estimate overall expenses.

Clicking on “more details” provides additional information, including the potential amount you might pay in interest throughout the loan duration. It also highlights how different interest rates and loan term lengths can impact the total interest paid. Furthermore, you’ll receive tips on ways to save on interest

What is included in a mortgage payment calculator?

This mortgage calculator payment shows you how much you’ll pay toward your principal and interest each month, but your actual mortgage payment will likely include a couple other charges.

Principal

The loan principal is the amount of money you borrow to purchase your home. For instance, if you are buying a home worth $400,000 and you have a down payment of $50,000, you would need to borrow $350,000. In this case, the loan principal is $350,000. Each month, you make payments that contribute towards reducing this principal balance over time.

Interest

This is what the bank charges you to borrow money.

Taxes

Mortgage lenders often include your property taxes in your monthly mortgage payment and manage this portion by holding it in an escrow account. This means that when your property taxes are due, the lender will use the funds from the escrow account to make the payment on your behalf. By incorporating property taxes into your mortgage payment, the lender ensures that these expenses are covered when they become due.

Insurance

Similar to property taxes, your homeowners insurance premium is also typically included in your monthly mortgage payment and allocated to an escrow account. This ensures that the funds for insurance coverage are set aside and available when needed. Additionally, if you made a small down payment or have an FHA mortgage, a portion of your monthly payment may also be allocated towards a mortgage insurance premium. This premium serves to protect the lender in case of default on the loan.

You may see this full mortgage payment amount referred to as “PITI.”

Related Posts

- House Mortgage – Meaning, Types, Loans and How it Works

- Perfection of Legal Mortgage and Procedure for Getting Loan Property

- How much is Mortgage Payments and how to calculate it

How to calculate a mortgage payment

Prefer to do it by hand? You can calculate your monthly mortgage payment (excluding property taxes and insurance) using the following equation:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

“P” is your principal.

The “i” represents the monthly interest rate, which differs from the annual interest rate stated in your mortgage documents. To calculate the monthly interest rate, divide the annual rate by 12. For instance, if your interest rate is 4.25%, divide 0.0425 by 12 to obtain your monthly rate: 0.00354166%.

To determine “n,” the number of months required to repay the loan, multiply the number of years by 12. For a 30-year mortgage, multiply 30 by 12 to get 360 months.

Once you have calculated “M,” the monthly mortgage payment, you can add the monthly property tax and homeowners insurance payment to it. If you don’t have these figures yet but want an estimate of your total monthly payment, you can refer to the average property taxes in your state and the average cost of homeowners insurance based on state and home value.

FICO credit score reports

- Credit Score Check, Reports and Highest Range in Your Finance

- Best Strategies to Improve Your Credit Score from 500 to 800

- What are the 5 Factors That Affect Your Credit Score? FICO Score

How a Mortgage Calculator can help

You’ve entered numbers into the mortgage calculator — so what can you do with this information?

1. Determine how much house you can afford

The mortgage calculator allows you to input your desired home purchase price and the amount you have for a down payment. By doing so, you can determine the total amount you need to borrow. If the resulting monthly payment is higher than what fits within your current budget, you may consider buying a less expensive home to make the monthly payments more manageable.

2. See how much more you need to save

The mortgage calculator also provides information on how different down payment amounts can impact your monthly mortgage payments. This allows you to evaluate whether you are prepared to make a purchase now or if it would be more beneficial to wait and save for a larger down payment. By considering the effect of various down payment amounts, you can make an informed decision about the timing of your home purchase.

3. Choose a term length

Try inputting different term lengths into the calculator to determine the one that aligns best with your budget. A 30-year term will result in lower monthly payments, but you’ll end up paying more in total over the extended repayment period. On the other hand, a 15-year term will lead to higher monthly payments but lower overall costs over the years. Experiment with various term lengths and consider which one aligns better with your financial goals and circumstances..

4. Find out how your interest rate affects payments

If you have received prequalification from multiple lenders, you can utilize the calculator to compare how the interest rates offered by each company would impact your monthly payments and long-term costs. This tool allows you to make a meaningful comparison between lenders and assists you in the process of selecting the most suitable lender for your mortgage. By inputting different interest rates, you can evaluate the potential differences in monthly payments and overall expenses, aiding you in making an informed decision.

5. Learn how to save money

Once you’ve entered your numbers, we provide a few suggestions on how you can either lower your monthly payments or save in the long term.

What is Amortization?

Amortization is the process of gradually paying off a debt, such as a mortgage, over time through regular monthly payments. With a mortgage, each monthly payment is allocated between reducing the principal amount owed and paying the interest charged on the loan.

When you take out a mortgage, you receive an amortization schedule that outlines the breakdown of each monthly payment, showing how much is applied to the principal and how much goes towards interest.

For instance, let’s consider a $300,000 mortgage with a 6.5% interest rate. The monthly payment is $1,896. In the beginning, a significant portion of the payment will go towards interest. Using the formula, the first payment of $1,896 will have $1,625 allocated to interest and $271 towards reducing the principal.

As you make subsequent payments, the interest portion gradually decreases while the principal reduction increases. The calculation is repeat each month using the remaining principal balance.

To simplify this process, you can use tools like Excel or online amortization calculators to generate a complete schedule that outlines your monthly payments and tracks the reduction of the principal balance over the life of the loan.

How lenders decide how much you can afford

Lenders have a responsibility to ensure that they lend an amount that borrowers can afford to repay. This is refer to as the ability-to-repay rule.

To determine the appropriate borrowing amount, lenders consider various factors such as your income, debts, assets, employment status, and credit history. Their aim is to ensure that you have sufficient income to afford the monthly mortgage payments and that taking on a mortgage won’t excessively strain your debt-to-income ratio (DTI). For conventional loans, a DTI above 50% is generally not allow, and borrowers with lower ratios often receive more favorable interest rates.

However, it’s important to note that just because a lender determines that you can afford a certain loan amount doesn’t necessarily mean that you’ll feel comfortable with the resulting monthly payment. It’s crucial to consider your personal budget and determine a price range that aligns with what you can comfortably manage on a monthly basis.

How to lower your monthly mortgage payment

You don’t want a high mortgage payment that will cause financial distress. There are several ways to lower your monthly payment:

- Make a larger down payment. The higher your down payment, the less you’ll need to borrow.

- Buy a less expensive home. If saving more for a down payment isn’t feasible, you may want to buy a home that costs less. This is another way to borrow less money with a mortgage.

- Improve your interest rate. Shop around for lenders to find the best rate and take steps like increasing your credit score or paying down debts to get a better rate.

- Choose a longer term. The longer your term length, the lower your monthly payment will be.

A mortgage calculator can help you see all of your options for buying a home and choose the terms that best fit your situation.

What are the Reasons Why your Monthly Mortgage Payment could increase?

Your monthly mortgage payment amount will likely change slightly over the years, and may go up over time. Two of the most common reasons for this include:

1. You have an adjustable-rate mortgage (ARM)

After the initial period of fixed interest rates on your adjustable-rate mortgage (ARM), the rate on your mortgage will start changing regularly. This means that your monthly payment could increase because of the changes in the interest rate.

2. Your taxes or insurance increased

Most borrowers pay their property taxes and homeowners insurance premiums into an escrow account, which the lender pays out of on your behalf when those bills are due. If your taxes or premium have increased, so will your monthly payment.

Conclusion

The advantage of using a Mortgage Payment Calculator is that it helps you determine how much you can afford to borrow for a home purchase and provides an estimate of your monthly mortgage payments. However, there are some Advantages and Disadvantages of Join Mortgage you should be aware of.

Secondly, by inputting various factors such as home price, down payment, interest rate, and loan term, the calculator can quickly calculate your monthly payment amount. This allows you to plan your budget accordingly and make informed decisions about your home purchase.

Additionally, the calculator can help you compare different scenarios, such as adjusting the down payment or loan term, to see how they affect your monthly payments. Overall, the Mortgage Payment Calculator is a useful tool for understanding the financial implications of taking on a mortgage and making informed choices.

Read Also:

- What is Mortgage Home Loan, Types and Process of Securing it?

- How Much does Mortgage Loan Officer Earns as Salary or Commission?

- How To Get A Mortgage Loan: 7 Steps To Get Approved for Home Loan

- How to Become a Mortgage Loan Officer in Nigeria, Ghana, UK, Canada, USA

- Joint Mortgages Loan: How to Buy a Home with Family Member [Husband, Wife, Children