What is going on with tech company stocks today in 2023 and which ones should watch to invest in? I will be examining the Top Tech Stocks to Watch or to consider in 2023 and acquaint you with the primary platforms that enable commission-free investing in these companies. There are both big and small tech companies to invest in right now, but do you know them?

The aim of this article is to provide you with a comprehensive understanding of the most popular tech stocks mentioned below. We will now explain each one, with their detailed profiles so as to highlight the potential risks and rewards associated with these investments.

List of Top Tech Stocks to Watch and Invest in

- Tamadoge

- Battle Infinity

- Amazon

- Alphabet

- PayPal

- Lumen Technologies:

- Apple Inc.

- Jack Henry Company

- Nvidia Corp

- Taiwan Semiconductor

- Nio

- Meta

1. Tamadoge:

Tamadoge is an immensely popular investment choice known for its wide appeal. While it has gained significant attention, it’s important to consider the inherent risks associated with its volatility and market fluctuations. Nevertheless, many investors find Tamadoge’s potential rewards attractive, making it a stock worth watching closely.

2. Battle Infinity:

Battle Infinity stands out as an exciting tech and crypto gaming platform. This industry offers tremendous growth potential, but it also carries risks, such as competition and regulatory challenges. It’s essential to carefully evaluate these factors before considering an investment in Battle Infinity.

3. Amazon:

Amazon remains a prominent tech stock, known for its dominant presence in e-commerce and cloud computing. With its strong market position and consistent innovation, Amazon has the potential for continued growth. However, regulatory scrutiny and intense competition can pose risks, warranting careful analysis.

4. Alphabet Inc:

Alphabet, the parent company of Google, is a tech stock with substantial long-term growth potential. Its diverse portfolio includes search, advertising, and other emerging technologies. While Alphabet has shown resilience and innovation, regulatory concerns and privacy issues should be taken into account.

5. PayPal:

PayPal is regarded as an affordable tech stock that presents opportunities, especially during market downturns. Its digital payment solutions have gained popularity, but factors like competition, changing consumer preferences, and regulatory developments need to be considered when evaluating its investment potential.

6. Lumen Technologies:

The Lumen Technologies appeals to dividend seekers due to its consistent dividend payments. As a telecommunications company, it operates in a competitive industry with evolving technologies. Investors should carefully assess factors like market conditions, technological advancements, and the company’s financial performance.

7. Apple Inc:

This Apple Inc has built a reputation for delivering consistent product innovation and maintaining customer loyalty. Its vast product ecosystem and strong brand position have propelled its growth. However, risks exist, including market saturation, competition, and reliance on a few key products.

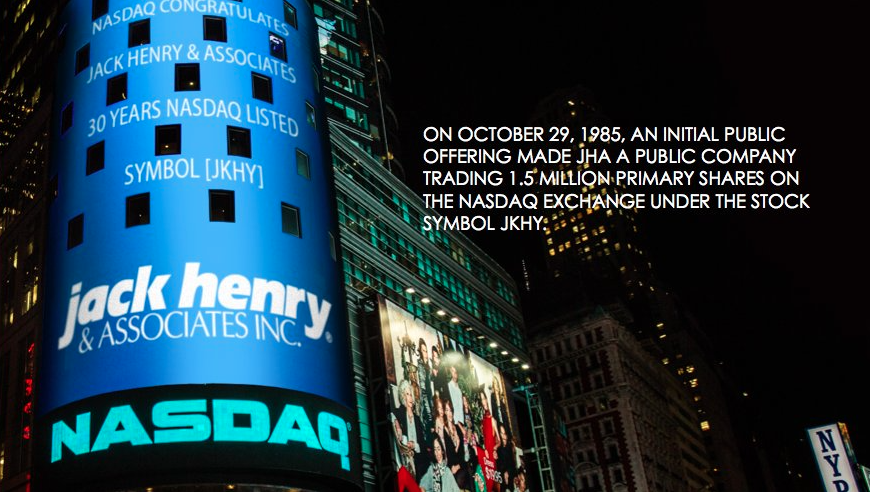

8. Jack Henry Company:

As a leading provider of core banking software, Jack Henry company plays a crucial role in the financial technology sector. While it operates in a stable industry, investors should evaluate factors such as technological advancements, customer demand, and competitive landscape before making investment decisions.

9. Nvidia Corp:

This Nvidia is a well-known tech company that focuses on graphics processing units (GPUs) and artificial intelligence (AI) technologies. Its innovative products have found applications in various industries. However, potential risks include competition, market demand fluctuations, and technological advancements.

10. Taiwan Semiconductor:

Taiwan Semiconductor holds a dominant market share as a manufacturer of semiconductors. Its growth potential stems from increasing demand for chips in various sectors. Factors such as geopolitical tensions, market conditions, and technological advancements can affect its performance.

11. Nio:

Nio is a Chinese tech company specializing in the manufacturing of electric vehicles (EVs). It operates in the rapidly expanding EV market, offering potential for growth. However, investors should consider factors like regulatory changes, market competition, and the company’s financial health.

12. Meta:

Meta (formerly Facebook) is a social media tech stock with a focus on the metaverse. The company presents unique opportunities and challenges. Its success hinges on user engagement, technological innovation, and navigating regulatory landscapes.

How to Judge the Most Popular Tech Stocks to Watch

While studying the balance sheet of a tech company, it’s crucial to look beyond just cash and debt. Here are a few key aspects to keep in mind:

- Firstly, examine the company’s assets, including both tangible and intangible ones.

- Secondly, analyze the liabilities, such as outstanding loans and obligations.

- Additionally, assess the equity section to understand the company’s ownership structure.

- Moreover, review the revenue and expenses to gauge the financial performance.

- Furthermore, evaluate the company’s investments and capital expenditures.

- Lastly, consider any off-balance sheet items that may impact the overall financial health.

Key aspects to Consider before Buying in or Investing in Tech Company Stocks

1. Revenue and Growth of the Tech Company Stocks:

I will advise you to look at consistency and sustainability revenue growth. This will definitely show you a strong market position and demand for their products and services.

2. Profitability of the Tech Company Stocks:

You have to make sure that you evaluate the company’s profitability by examining its net income and profit margins. Trust me, consistent and increasing profitability is a positive sign of a well-managed business.

3. Research and Development (R&D) Investment:

A lot of tech companies often invest heavily in R&D to stay competitive and drive innovation. Therefore, you have to try to assess the company’s R&D expenses and track records. Check if they are of bringing new products or services to the market.

4. Market Position and Competition of the Tech Company Stocks

Be sure to understand the company’s market position and competitive landscape. After that, you then consider factors such as market share, customer base, and barriers to entry. Remember that companies with a strong market position and a competitive advantage are more likely to thrive in the long run.

5. Management Team of Tech Company Stocks:

Try to evaluate the experience and track record of the company’s management team. Carefully look for leaders who have successfully guided the company through challenges and have a clear strategic vision for the future.

6. Industry Trends and Outlook of the Stocks:

Research is key to updates and information. Therefore, you must stay informed about the latest trends and developments in the tech industry. Try to consider how the company is positioned to take advantage of emerging technologies or changing consumer behavior.

7. Valuation of the Tech Company Stocks:

Do not forget to assess the company’s valuation metrics. Scrutinise the price-to-earnings ratio (P/E ratio), price-to-sales ratio (P/S ratio), and price-to-book ratio (P/B ratio). When you are done, go ahead to compare these metrics to industry peers to determine if the stock is overvalued or undervalued.

8. Analyst Recommendations and Investor Sentiment:

Always review analyst recommendations and investor sentiment towards the stock. Yes, this information can provide insights into market expectations and the perceived potential of the company.

Conclusion

In summary, please remember that investing in stocks involves risks, and it’s important to conduct thorough research and consider your own investment goals and risk tolerance before making any investment decisions. Consulting with a financial advisor or broker can also provide valuable insights tailored to your specific situation.

You can take some time to analyze the risks and rewards associated with each of these tech stocks. After that, you can now make more informed investment decisions. Finally, please make sure you remember to consider your risk tolerance, conduct thorough research, and seek professional advice when necessary.

Note: This is not a legal or financial advise website. Your use and investment into any company is subject to your own decision.

Hottest Post for the Week

- How to Make Money Online – 5 Ways You Can Make Today

- How TikTok is Taking over Mobile Monetization Ads Revenue

- Cryptocurrency Earnings – How to Earn Free Bitcoin in Market

- Use Apple Pay for Contactless Payments on iPhone, iPad and Watch