Do you often ask of the Difference Between FICO® Scores and Credit Scores? Well, FICO Score and credit score may sound the same, but there’s a slight difference. However, this guides will show you the difference so that you don’t mix the two when preparing to take a loan.

FICO Score is a specific type, while credit score is a broader term for evaluating your creditworthiness as an account holder. ” You can think of a credit score as a computer model that analyzes credit reports to determine a score”. FICO Score is a specific brand used by many lenders in the US and Canada, but others may have their own models or use competitor’s scores.

Is a FICO® Score the Same as a Credit Score?

Like other credit risk scores, FICO Scores estimate the chance of someone being late by 90 days on a bill in the next 24 months. FICO accomplishes this by using intricate algorithms that consider data from your credit report provided by the national credit bureaus: Experian, TransUnion, and Equifax.

FICO regularly introduces updated versions of its scores, changing them to the databases of each credit bureau. This results in multiple FICO Scores. Furthermore, other companies like VantageScore® develop credit risk scores that analyze consumer credit reports in a similar way.

Credit scoring models access consumer credit behavior, where individuals with higher scores are consider less likely to miss payments compared to those with lower scores. As a result, having a higher credit score can increase your chances of obtaining more favorable terms when applying for credit

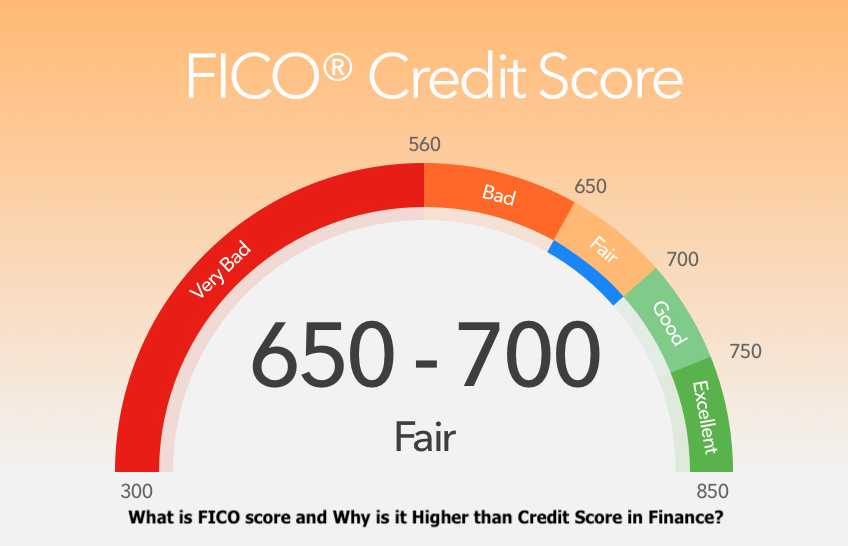

FICO and VantageScore credit scores have a range of 300 to 850 and classify consumers into different credit scoring ranges. For example, a FICO Score between 800 and 850 is considered “exceptional.” However, despite using the same score range and credit report information, each scoring model has its clear method, which can lead to different scores.

FICO not only produces general credit scores but also develops specialized scores based on your credit reports. Take for instance, they provide credit-based insurance scores and bankruptcy scores. These scores aim to predict the likelihood of filing an insurance claim or declaring bankruptcy, respectively.

Helpful Guides

- Credit Score Check, Reports and Highest Range in Your Finance

- How Can Poor Credit Score Hurt My Social Security Benefits?

- Can you get Closed Account Removed from Credit Report?

- Can I Get a Car Loan with a Repossession on my Credit?

Why Are My FICO Scores Different from my Records?

From what can be seen above, FICO makes different FICO Score models to match each credit bureau’s reports. Also, FICO regularly introduces new models to keep up with changes in consumer behavior, regulations, and technology. Since lenders and businesses use various scoring models, you may have multiple credit scores, possibly even hundreds.

Take the FICO 10T score as an example, which is a variation of the latest FICO Score 10. It considers trended data, examining your account management over the past 24 months. However, lenders may still depend on older models like FICO Score 8 or 9, or even earlier versions, to assess loan or credit card applications. On the other hand, they may use VantageScore’s credit scoring models like the recent 3.0 and 4.0 versions.

FICO’s base scores are not designed for a particular lender or loan type. However, FICO® also develops industry-specific scores for auto lenders and credit card issuers. These models increase the base model to provide lenders in those industries with a customized score, ranging from 250 to 900. You can take a look at the Best Strategies to Improve Your Credit Score from 500 to 800 as an account holder in any financial insitution.

What Is My Real Credit Score?

Companies have the freedom to select and utilize specific credit scores when assessing applications and managing customer accounts, contributing to competition in the credit scoring industry. Therefore, there is no single final “real” credit score.

For example you’re looking for an auto loan and receive offers from different lenders. Each lender may use a different scoring model like FICO Score 8, FICO Auto Score 2, or VantageScore 4.0. While your scores may differ, they are all valid as lenders rely on them to assess what it takes for a loan and determine the rates and terms they can provide you.

More often, you won’t know which of your three credit reports or which credit score a lender will use. However, since credit scores are based on the same data, establishing positive credit habits can lead to good credit scores across different models. On the other hand, negative factors like late payments or bankruptcy can hurt all of your credit scores.

Read Also:

- What are the 5 Factors That Affect Your Credit Score? FICO Score Reports

- When Does Capital One Report to Credit Bureaus About Your Credit Score

- Cash Back Credit Cards: Types, Comparison, Rewards, Pros and Cons

Check Your FICO® Score for Free

Among the various FICO Score versions, FICO Score continues to be extensively used. This is due, in part, to the costs and efforts involved in change to a new scoring model for lenders.

You can access your free FICO Score based on your credit report online. It provides insights into the factors that positively or negatively affect your scores and allows you to monitor your score’s progress over time.

Learn More About the Types of Credit Scores

- Which Credit Scores Do Mortgage Lenders Use?

Many mortgage lenders use specific credit score versions when determining if you’ll qualify for a mortgage and the rates you’ll receive. - The Difference Between VantageScore® Scores and FICO® Scores

Your credit score can vary depending on whether it’s a VantageScore® or FICO® Score. Learn how these scores differ. - Why Do I Have So Many Credit Scores?

Did you know you likely have many credit scores instead of just one credit score? Here’s why. - What Are the FICO® Score Versions?

You May Also Like This

- Rebuild Your Credit Score After Repossession for Missing Payments

- Credit Score Check, Reports and Highest Range in Your Finance

- What is FICO score and Why is it Higher than Credit Score in Finance?