Yes, you can remove a Closed Account from your Credit Report without loosing your reward or 90 days bonuses. This article will teach you how it is done. But first, as a cardholder, you can try several simple and available ways to remove a closed account from your credit report. But before you begin, bear in mind that it can affect your credit score with the company. Furthermore, your personal borrowing history may even remain on your report even after you’ve successfully closed the credit account.

Thousands of citizens do not know that every time they make a loan or credit card payment (or miss a payment), this information likely appears in your credit report. This alone will either help to determine your credit score positively or negatively. If you think the history wipes away, you will have to have rethink because it doesn’t. Even a long time after you close your credit account or pay off the loan you took, your borrowing history will remain on your credit report. That’s the fact. But you can look at the Best Strategies to Improve Your Credit Score from 500 to 800 for details.

What we are trying to tell you is that a closed account can continue to affect your credit score. Depending on how you make payments for your credit or loan, your records may be for better or worse, possibly for many years. But the great news we bring to you todays is that you may be able to remove the closed account from your credit report history. With this you can be free of negative history.

Check out these New Updates

- 5 Steps to Lower Your Credit Card Interest Rate

- How to Borrow Money with Instant Cash Advance

- Credit and Debit Card Safety Precautions

- Find Your Dream Job Here to Launch Your Career

Mr. Bruce McClary, who’s a senior vice president of membership & communications at the National Foundation for Credit Counseling has this to say; “Any account or card holder can issue a request to a bank or financial institution to have a closed account permanently removed from their credit files.”

But note that banks as well as other financial institutions are not a one man business. they have standing laws, terms and conditions. Therefore, your request is not completely guaranteed to be granted. Even as this might be so unfortunate, here is what you need to know about removing closed accounts from your credit report successfully.

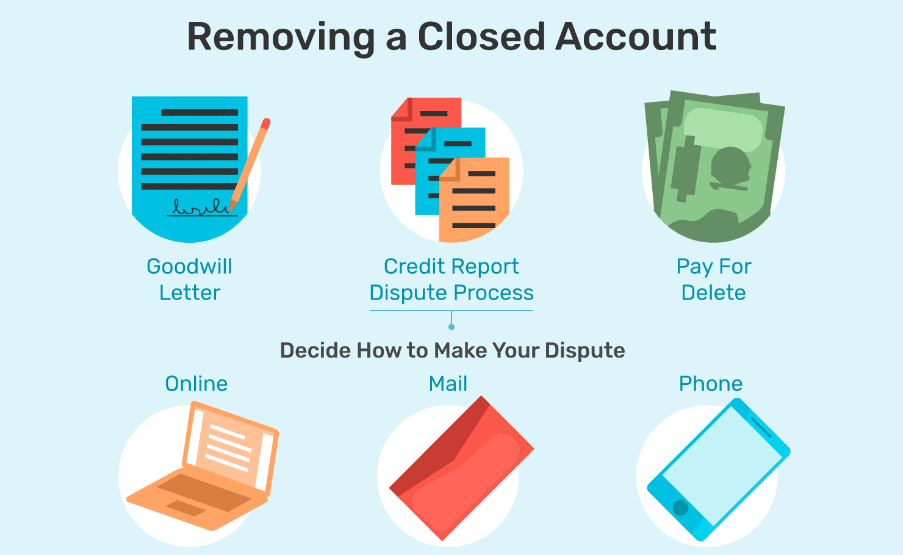

How to Remove a Closed Account From Your Credit Report

Written below are among the ways to try to remove a closed account from your credit report:

Transactional Dispute errors on your credit report.

Ma’am Margaret Poe, who’s head of consumer credit education at the credit bureau TransUnion usually advises customers on transactional dispute errors. In one of her interviews, she has this to say; “If a credit account listed on your credit report has a mistake from the financial officer or the result of fraud, you can simply submit a dispute request to enable them remove.”

The meaning of this, is that you must have to file a dispute in writing (email or paper) with each of the three bureaus separately. More importantly, you have to include supporting documents to your claim. When the credit bureau gets it, they will investigate the issue thoroughly. If they discover any discrepancies, or any negative item, they they will confirm or correct the history. If you’ve read correctly, you will notice that an item may be only updated but not entirely wiped from your credit report.

Send in a “goodwill” deletion message.

Look up the creditor that directly reported the information to the credit bureau. Then, you can send-in a well written request to remove the account from your credit report. First, you have to calm down & politely ask if they can remove the account now that it is no longer active, especially if you loan repayment is complete. While you are on it, be aware that there is no need to send the request to the credit bureau unless the validity of the account is questionable.

Unfortunately, this option isn’t always very successful in most cases. This is because the credit bureaus aren’t compelled to remove closed accounts. However, you can still ask them if you have a positive credit history together with a long relationship with the creditor.

Patiently Wait for the account to fall off your credit report.

This is the last option to try. After using other methods to clean your negative credit history and it is still unsuccessful, don’t worry, but you have to wait patiently. This is because, with time, the account will disappear from their server since it is no longer in use. Depending on the status of the account, it will age off credit reports after 7 or 10 years.

In order words, accounts closed also in good standing may stay on your credit report for up to 10 years. This will as well help your credit score to increase generally. It is not one sided as negative information may also remain on your credit report for more that 7 years, up to 10years.

How Does a Closed Accounts Affect Your Credit?

Generally, a closed account that remains on your financial credit report can affect your credit in different ways. This is however based on your financial habits, says Tom Quinn, the VP of scores at Fair Isaac Corporation (FICO).

As we have previously noted, even after an account is closed, a strong history of paying on time can help your credit score positively. You will want to ask; How Can Poor Credit Score Hurt My Social Security Benefits? Find out.

According to Mr. Quinn of the credit bureau Experian, the positive effect will never be the same as an open account, but it can still strengthen your credit score. In such case, a disappointing account can continue hurting your credit after it is finally closed.

“Always know that late payments will continue to impact your account negatively. In addition, the impact can be significant, as payment history makes up 35% of your score,” he says.

The credit bureau Experian, Mr. Quinn, notes that the specific effect on your score will depend on your credit behavior before the late payments. It will also put into considerations your credit profile and other factors too.

We have been saying it that damage to your credit score can linger for years. Even late loan payments can remain on your credit report for a time periods up to 7. Unfortunately, if you decide to file for Chapter 7 bankruptcy, you might as well have to wait even longer. This can be up to 10 years from the date you filed the bankruptcy documents.

When Should I Remove a Closed Account From Your Credit Report?

As a Cardholder, you may want to completely remove a closed account from your credit report if the account has a negative payment history standing. Why? It will be hurting your credit score value. Or else, you can aim to leave accounts closed in good history on your credit report for a long time.

Most banking terms states that “Accounts with a positive history of on-time payments reflect a healthy and positive credit report standing. Yes! this can in turn, can benefit your credit score. This is true whether the account remains open or completely closed.”

Better still, how you presently manage the closed account, combined with other information in your credit report matter a lot. As this will go a long way to determine the effect of removing the account on your credit score, Quinn says. On the whole, “removing a closed account could cause either a score increase, decrease or have no impact at all,” he says.

Why will you remove your account if you have a good score?

Look at these facts for example; if you’ve completely paid debt without faulting as agreed, it doesn’t make much sense to request removal of an account. Why? Because you will have a wonderful standing with the financial institution. It is only when you fault in payments that you will be looking for how to remove a closed account from your credit report. With all these information, you can see How to Consolidate Credit Card Debt without Hurting your Credit as a reference.

What we are saying is that; removing an account in good standing from your credit report will backfire in other ways. You will be the one one the loosing end because your nice score will disappear. Yes, it can hurt your credit utilization ratio as well as other important factors that determine your credit score.

“By closing the card, you are essentially wiping away some of your available credit and potentially increasing your credit utilization ratio,” Quinn says.

That can cause your credit score to dip. Closing a card can also hurt the length of your credit history and your credit mix, two other factors that affect your score.

How Long Does a Closed Account Stay on My Credit Report?

A closed account in good standing will remain on your credit report for up to 10 years.

Remember, the presence of this type of account on your credit report is a positive. As TransUnion and Experian note, a closed account that shows a positive history of payments is likely to help your credit score.

In neutral sense, a closed account with negative history can continue to hurt your credit score for 7 years or more. “This can be very antagonising or frustrating for the borrower but be happy because the damage will eventually fade”, McClary says.

“Going forward, the passage of time plus the combination of continued timely payments for open accounts can help reduce the negative impact of a closed account,” he says.

Practice Good Credit Habits When you Borrow – Pay Back & Timely

It may not be an easy task but you can practice good credit habits to keep accounts in good standing. Even though it is difficult, it will help your credit score if the accounts are closed. Meaning that you will pay bills on time, keeping credit utilization low, check your credit score regularly. Check your monthly earning or salary before you take a credit. Ultimately, please ensure you apply for new credit only when there’s a very pressing need for it.

My advise now is this; If you haven’t already known your credit score, pls do so. You can also consider the factors that might be keeping it lower than it should be. Take for example, using too much of your available credit money will likely weigh down your credit or bonus score. Just have a clear focus on reducing credit card balances because it will really make sense.

The next thing to do, is to create an action plan based on the factors that can help you increase your credit score over time. When on o loan, you can create a repayment template so you don’t pay late.

Conclusion

There are simple as well as consistent actions, such as paying your credit card and loan bills on time every time. These simple actions can boost your credit score. Your payment record is the largest factor in determining your credit score. For that reason, deciding to make timely payments can have a positive impact.

It is recommended that you also check your credit reports regularly. This is to quickly catch any inaccuracy of reports that may undermine your credit score. “If you see incorrect information, you can file a dispute directly with the credit bureau,” McClary says at his interview. Finally, take a proactive approach to accounts that are causing you to fall behind on payments, he says. Cut down some personal needs so as to raise more money to clear your credit.

On last notes, don’t wait to get help when you need it. Try and reach out to a nonprofit credit counselling agency for an affordable repayment plan. It is sure that they will provide you with guidance to get your budget back on good track. We wish you well. Good luck.

Editors Recommendations

- Cash Back Credit Cards: Types, Comparison, Rewards, Pros and Cons

- How to do Credit Card Balance Transfer to Another Issuer with No Fee

- How to Consolidate Credit Card Debt without Hurting your Credit

- How does Cash Back Credit Card Work for Account Holders?