Canadian mortgage rates refer to the interest rates charged by financial institutions, such as banks and lenders, for borrowing money to purchase a home in Canada. These rates determine the cost of borrowing and are typically expressed as a percentage.

Mortgage rates can vary based on some factors, Market up-date and term. This article provides you all you need to know about the Best Canadian Mortgage rates.

Guide to Canadian Mortgage Rates

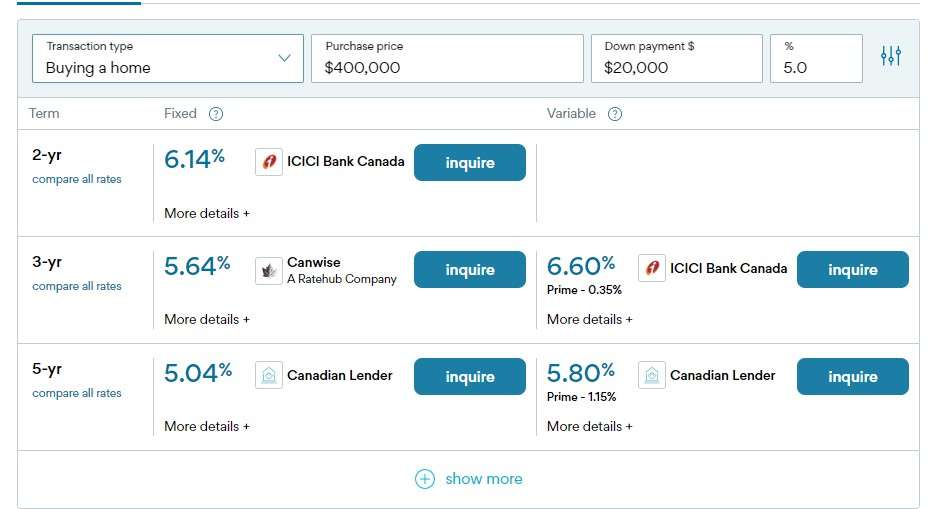

Best mortgage rate comparison

We look at different brokers, lenders, and banks in Canada to find the best deals with the lowest interest rates. We update the mortgage rates at the top of this page very often, so they are the most current and attractive rates available.

If you want to know what rate you could get for a mortgage, you can use our mortgage quote tool. It’s simple to use, doesn’t cost anything, and you don’t have to commit to anything.

Canadian Mortgage rates Market Update

The Canadian mortgage rates market has been going through some ups and downs in the past few weeks due to unexpected interest rate increases by the Bank of Canada on June 7. This led to a rise in yields in the bond market, which has affected mortgage rates. Here’s what today’s mortgage shopper should be aware of

CPI update

The Bank of Canada pays close attention to inflation, which is how prices go up over time. They use their benchmark interest rate to control inflation. When inflation is too high, the bank raises the rate to slow down spending and borrowing, which helps reduce inflation.

On the other hand, when the economy is slow, the bank lowers interest rates to make borrowing cheaper, which encourages people to spend more. In May, the consumer price index in Canada was 3.4%, which is lower than the previous month. This suggests that the bank’s previous rate increases are working to cool down the economy.

People are now wondering if the bank will keep the interest rate steady or raise it again. Some economists think there might be one more increase this year, bringing the rate to 5%. The bank will announce its decision on July 12

Bond market update

The price of government bonds directly affects the fixed mortgage rate market, and in 2023, bonds have been experiencing significant changes. Bond yields have been fluctuating as markets and investors react to economic data that hints at a potential recession or actions taken by the Bank of Canada.

The consumer price index (CPI) numbers for May showed some positive signs, causing bond yields to slightly decrease to around 3.6%. This has helped alleviate some of the upward pressure on fixed mortgage rates. However, it is still uncertain whether bond yields will continue to decrease in the future.

Real estate update

In May, the Canadian real estate market displayed strong resilience and growth, with buyers actively participating in the spring selling season. Recent data from the Canadian Real Estate Association (CREA), released on June 15, revealed that home sales reached a total of 54,241 transactions nationwide.

This reflects a 1.4% increase compared to the same period last year and a 5.1% increase from the previous month. CREA reports that approximately 70% of markets are witnessing a robust recovery in demand, including prominent regions such as the Greater Toronto Area, Montreal, Greater Vancouver, Edmonton, and Ottawa..

Highlights from the Bank of Canada’s June 7, 2023 announcement

On June 7, 2023, the Bank of Canada raised the target for the overnight rate by 25 basis points, bringing it to 4.75%.

- Canadians who have variable-rate mortgages and home equity lines of credit (HELOCs) should expect an immediate increase in their interest rates. If they have a variable-rate mortgage with fixed payments, it is highly likely that their rates will surpass the predetermined trigger rates, if they haven’t already.

- This announcement will not have an immediate impact on Canadians with fixed-rate mortgages. However, the rates for fixed mortgages had already been increasing in anticipation of a rate hike. With the announcement and the volatility in the bond market, fixed mortgage rates are expected to rise even further.

- There should be pre-approval for anyone who is planning to obtain a fixed-rate mortgage as soon as possible to protect themselves from further rate increases.

- The recent rate hike will result in stricter criteria for the mortgage stress test. This means that it may be more challenging to qualify for a mortgage. To determine how much you can potentially qualify for, you can utilize our mortgage affordability calculator. This tool helps you estimate the amount you may be eligible to borrow based on your financial situation.

- In its statement, the Bank of Canada restated its dedication to reducing inflation to its target rate of 2%. It emphasized that it would closely monitor important economic indicators like the Consumer Price Index (CPI) to assess the need for additional interest rate increases. Therefore, if inflation and other relevant factors continue to move unfavorably, there is a chance that another rate hike may be announced at the Bank’s next announcement on July 12.

Factors that can affect your personal interest rate

It’s necessary to understand that the best mortgage rate you qualify for may change depending on your unique borrowing profile. Here are some of the factors that influence what mortgage rate you qualify for:

The Type of Mortgage

If you are refinancing your mortgage instead of purchasing a new home or renewing your existing mortgage, it’s important to note that you may be eligible for higher interest rates. Lenders typically offer higher rates for refinancing compared to new purchases or renewals.

However, if you have good credit and more than 20% equity in your home, there are additional options available to you. In addition to refinancing, you can also consider exploring a home equity line of credit (HELOC).

Your down payment

When purchasing a home and your down payment is less than 20% of the purchase price, and the value of the home is less than $1 million, you will be required to obtain mortgage default insurance, also known as CMHC insurance. This insurance is added to your mortgage amount and helps protect the lender in case of default.

While it does come with a cost, it can lead to a lower mortgage rate because it reduces the risk for the lender. When renewing your mortgage, in order to qualify for the lowest mortgage rates, you would have needed to purchase CMHC insurance when you initially obtained the mortgage.

Your Intended use of the Property

If you plan to rent your property out vs, live in it as a primary residence your mortgage rate will higher.

Your Amortization Period

In Canada, for insurable mortgages (homes valued under $1 million with a down payment less than 20% of the purchase price), the maximum amortization period is 25 years. However, if you make a down payment of at least 20%, you can access a mortgage that allows a longer amortization period, such as 30 years.

While longer amortization periods generally lead to lower monthly payments, they may come with slightly higher interest rates. It’s important to note that choosing a longer amortization period means paying more interest over the life of the mortgage compared to a shorter period.

Similar Post:

- How Does In-House Financing Work in Mortgage?

- What Happens When Lenders Repossess Homes on Mortgage?

- How to Apply for Mortgage Loan in Nigeria with Legal Requirements

- Current Mortgage Rates Today to Compare Weekly Low Interest Rate

- Advantages and Disadvantages of Joint Mortgage Loan for Family Home

Choosing the mortgage with the best rate that’s right for you

Variable vs. fixed mortgage rates

The distinction between fixed and variable mortgage rates lies in whether they will remain constant or fluctuate throughout the term of your mortgage. Fixed rates remain unchanged during the specified mortgage term, typically around 5 years. In contrast, variable rates are tied to your lender’s prime rate and can change as the prime rate fluctuates.

Fixed mortgage rates:

Fixed mortgage rates have been a popular choice historically, particularly 5-year fixed mortgage rates, as indicated by their significant share of mortgage requests on Ratehub.ca in 2022. One of the key advantages of a fixed mortgage is the protection it provides against interest rate fluctuations.

With a fixed rate, your regular payments remain consistent throughout the term, regardless of market conditions. This stability can be beneficial if you prefer a low-risk approach. By opting for a fixed rate mortgage, you know your monthly payments from the beginning and do not need to continuously monitor interest rate changes.

Variable mortgage rates:

Variable mortgage rates are typically lower than fixed rates initially but are subject to change over the term of the mortgage. These rates are influenced by market conditions, specifically the prime rate.

As a result, your payment amounts can vary over time. In recent years, variable rates remained lower than fixed rates, leading many buyers to choose 5-year variable-rate mortgages.

However, the popularity of variable-rate mortgages has decreased as they have surpassed fixed rates due to consecutive rate hikes between March 2023 and January 2024.

While variable rates generally offer lower initial rates, they carry more risk as they can fluctuate. It’s important to note that since the end of 2023, variable rates have actually been higher than fixed rates. Here are the variable mortgage rate and the key advantage you need to know

- You can convert a variable rate to a fixed rate at any time without a penalty as long as you stay with your original mortgage lender.

- Breaking a variable rate mortgage typically incurs lower costs compared to breaking a fixed rate mortgage. If you need to estimate the expenses associated with breaking your mortgage, our mortgage calculator can be a helpful tool. It allows you to calculate the approximate penalty amount you might incur when terminating your mortgage early.

According to a significant study conducted by York University Professor Moshe Milevsky in 2001, the findings suggested that historically, more than 90% of Canadians who held a variable mortgage rate for the entire duration of their mortgage term ended up paying less in interest compared to those who chose a fixed rate.

This study provides evidence that variable rate mortgages have, on average, been more cost-effective in terms of interest payments.

Selecting a Mortgage Term

The decision between a short-term and long-term mortgage can impact the interest rate you receive. Short-term mortgages typically come with lower interest rates. They require more frequent renewals, which can be advantageous if interest rates remain low during each renewal period.

Long-term mortgages, on the other hand, offer stability as they don’t require frequent renewals. However, long-term mortgage holders may miss out on the opportunity to benefit from lower interest rates if market conditions change.

It’s important to consider your personal preferences and the current market conditions when choosing between short-term and long-term mortgages.

Open vs. closed mortgages

When deciding between an open or closed mortgage, it’s important to note that while open mortgages offer flexibility in certain situations, the vast majority of Canadians choose closed mortgages. Closed mortgages are more popular due to their lower interest rates and because most homebuyers do not plan to pay off their mortgages in the short term.

It’s worth mentioning that fixed-rate open mortgages are not available, and variable-rate open mortgages are uncommon. The most common form of open mortgage is the Home Equity Line of Credit (HELOC). For more detailed information about the differences between open and closed mortgages, you can refer to our blog post on the topic

Closed mortgages:

This mortgage terms generally offer lower interest rates compared to open mortgages. Closed mortgages can be either fixed or variable, but they have limitations on the amount of principal you can pay off each year.

If you decide to pay off the entire principal before the designated term of a closed mortgage, you will incur a prepayment penalty, typically equivalent to a three-month interest charge. It’s important to be aware of these penalties when considering prepaying a closed mortgage.

Open mortgages:

Open mortgages provide the flexibility to pay off the entire mortgage balance at any time during the term. However, this flexibility comes at the cost of higher interest rates compared to closed mortgages.

Choosing an open mortgage might be suitable if you anticipate a need to move in the near future or if you expect a significant sum of money, such as an inheritance or bonus, that would enable you to make larger payments towards your mortgage.

It’s important to weigh the benefits of flexibility against the higher rates associated with open mortgages and consider your specific financial situation and future plans when making a decision.

How do I qualify for a Canadian mortgage rates?

When applying for a Canadian mortgage rates, it’s important to consider the basic requirements that lenders will assess to determine your eligibility and approval. Here are some key factors that lenders typically consider:

A good credit score

To qualify for the best mortgage rates, having a credit score of 680 or higher is generally recommended. However, to qualify for a mortgage at all, you typically need a minimum credit score of around 560.

Lenders will not only look at your credit score but also consider any derogatory information on your credit report, such as missed payments that may have gone to collections.

If you have bad credit, typically defined as a how your credit score impacts your ability to obtain a mortgage credit score below 660, it becomes challenging to qualify for the best mortgage rates, and you may need to work with sub-prime mortgage lenders like Equitable Bank or Home Trust.

Secondly, if your credit score is even lower, below 600, you might need to approach private lenders such as WealthBridge. Sub-prime mortgage lenders are willing to work with individuals who have a poor credit history but often charge higher mortgage rates.

Genetally, I will advise you to understand how your credit score impacts your ability so that you can get a mortgage and explore your options accordingly.

Proof of income

In addition to credit history, another important aspect when applying for a mortgage is providing proof of income. Lenders typically require pay stubs and/or tax documents, such as your Notice of Assessment (NOA), to verify your income.

It’s important to note that if you have recently started a new job, even with proof of income, some lenders may prefer to see a minimum one-year employment history in the position to establish stability and reliability of income.

Ability to pass a mortgage stress test

To qualify for the desired mortgage amount, you must successfully pass a mortgage stress test. The purpose of this test is to ensure that you can afford your mortgage payments even at higher interest rates.

The stress test is based on the higher of two rates, your contract rate plus 2% or the qualifying rate set by the Office of the Superintendent of Financial Institutions (OSFI).

For instance, if you were offered a mortgage rate of 4.45%, the lender might conduct a stress test to determine if you can afford payments at 6.45% (4.45% + 2%) since it exceeds the qualifying rate of 5.25%. This test helps protect borrowers by ensuring they can manage their mortgage payments even if interest rates increase.

Historical Canadian Mortgage rates

Examining historical Canadian mortgage rates can be a helpful method to determine which types of mortgages typically come with higher rates. It also enables you to gauge whether the current rates are relatively low or high in comparison.

Here are some of Canada’s lowest mortgage rates of the year for different types of mortgages over the past five years.

| 2018 | 2019 | 2020 | 2021 | 2022 | |

| 5-year fixed | 2.79% | 2.29% | 1.39% | 1.39% | 1.39% |

| 5-year variable | 1.85% | 2.36% | 0.99% | 0.85% | 0.85% |

| 1-year fixed | 2.69% | 2.49% | 1.64% | 1.54% | 1.99% |

| 3-year variable | 1.99% | 2.89% | 2.35% | 0.99% | 0.99% |

| Prime Rate | 3.20% | 3.95% | 2.45% | 2.45% | 2.45% |

Conclusion Canadian Mortgage Rates

The “Best Canadian Mortgage Rates: Market Update – Factors and Terms” provides all the necessary knowledge you need to be familiar with regarding the current status of mortgage rates in Canada, including the factors influencing them and the associated terms.

Read Also:

- Mortgage Interest Rates Predictions: Will Bank Rates Go Down?

- Mortgage Interest rates Drops When Exactly as Projected in 5 years?

- Home Mortgage Demand drops to Lowest Level as Interest Rate rises

- JPMorgan warns UK interest rates could hit 7% in Car and Mortgage Loan

- How Much does Mortgage Loan Officer Earns as Salary or Commission?