A Mortgage Loan Amortization Calculator is a financial term that is use for paying off your mortgage in monthly installments according to an Amortization schedule. These payments are apply to your loan principal as well as interest, Usually, more of your payments go toward the interest earlier in your repayment term.

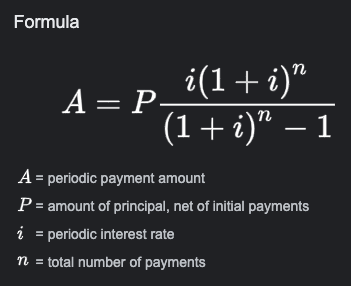

The amortization schedule calculator provides you with monthly payment amounts for an amortized loan. Additionally, it displays a schedule, graph, and pie chart breakdown to help you visualize the loan repayment process. It also provides free amortization schedule with fixed monthly payment formula calculations.

Normally, most mortgages are amortized, so you’ll know exactly what you owe each month without any surprises. You can use an amortization calculator like the one below to estimate your monthly payment schedule. Feel free to visit my previous post where there’s a guide on How to Calculate Your Loan Payments for Free.

How to Use the Mortgage Loan Amortization Calculator

A Mortgage Loan Amortization Calculator is very helpful as it helps you to estimate how your payment schedule will be break down month by month. After entering the loan amount, repayment term, interest rate and loan start date, you’ll see how much your monthly payments will be and how many payments you’ll owe over the life of the loan. Also will see your total interest cost and total repayment as well as your estimate payoff date.

Furthermore, you have the option to indicate if you plan to make extra payment to get an idea of how much you could save on interest and if you could shorten your repayment time.

Definitions of Mortgage Loan Amortization Calculator

Loan amount

This is the amount you borrow from your mortgage lender to cover the purchase of your home.

Interest rate

This is the interest Lenders charge in return for allowing you to borrow money. Your mortgage interest rate represents how much you will be charge in interest, expressed as a percentage of your loan principal.

Loan term

This is the number of years you have to repay your mortgage. Common mortgage terms include 10, 15 and 30 years, though other terms are also available.

Number of payments

This represents the total number of monthly payments you’ll make over the loan term. For example, if you have a 15-year loan, you’ll make roughly 180 monthly payments.

Monthly payment

This is how much you’ll be require to pay each month. A portion of this will go toward your loan principal while the rest will go toward interest.

Extra payments

If you’d like to pay off your loan faster, making extra payments could be a good strategy. This can also save you money on interest.

Lump-sum payment

If you have extra money in the bank, you might decide to put it toward your mortgage—this is known as making a lump-sum payment. In this case, you could opt to recast your mortgage, which won’t change your loan term or interest rate but can lower your monthly payments with a shorter amortization period.

Principal and interest Mortgage Loan Amortization Calculator

Your loan principal is the exact amount you borrow from the lender. Interest is what you pay the lender in exchange for borrowing money. Your monthly payments will be divide between principal and interest. Typically, your payments will cover more interest earlier in your loan term while later payments will be mostly apply to your principal.

Total interest Mortgage Loan Amortization Calculator

This is the total amount you’ll pay in interest charges over the life of your loan.

Total cost of the Mortgage Loan Amortization Calculator

This is the total you’ll pay on your mortgage, including both principal and interest.

Payoff date

This is the estimated date by which you’ll have paid off your entire loan.

What Is Mortgage Loan Amortization Calculator?

Mortgage amortization is a financial term that refers to the process of paying off your mortgage in monthly installments according to an amortization schedule. Your mortgage amortization schedule will show how your monthly payments will be split between principal and interest and how this will shift over time as you pay off more of your loan.

In general, most of your payments will go toward paying off the interest compared to the principal on the front end of the loan period. In other words, interest is front-loaded at the beginning of the loan period. However, this will reverse over time, and you’ll eventually pay more toward the principal and less toward interest over the course of the loan.

How Mortgage Loan Amortization Calculator Helps You

Calculating your mortgage amortization can help you figure out how several important details about your loan, including:

- How much you’ll pay toward principal and interest each month

- How much you’ve paid in total so far each month—and how much you still owe (now or at a future date)

- What your total interest and repayment costs will be

- How making extra payments can save you money on interest or shorten your repayment time

You can also use the mortgage amortization calculator to estimate information like how much you’d need to pay extra to pay off your loan by a certain time or how much home equity you’ve built.

How to Pay Off Your Mortgage Faster

There are several strategies that could help you pay off your mortgage faster such as:

Making extra payments

Whether you put a little extra toward your loan each month, make an extra payment each year or make biweekly payments instead of monthly, this can help you repay your loan more quickly and save you money on interest.

Recasting

If you have some additional funds in the bank or come into some money unexpectedly, you might consider making a lump-sum payment toward your mortgage and recasting the loan. While this won’t change your interest rate or term, it will lower your monthly payments—and if you opt to apply your savings to your loan, you could pay it off even faster.

Refinancing

You could also consider refinancing your mortgage, which is where you pay off your old loan with a new loan with different terms. Depending on your credit, this might get you a lower interest rate, which could save you money on interest and potentially help you pay off your loan faster.

You could also choose to shorten your repayment term—but while this will reduce your overall interest costs, it will also likely increase your monthly payments.

Keep in mind that some lenders charge prepayment penalties. So if you plan to pay off your mortgage ahead of schedule, be sure to check with your lender or review your loan agreement to see if any of these fees will apply to you. There are some loan amortization calculator with extra payments excel you can download from the internet. Make use of it and get rest of mind by knowing exactly what you owe so that you device the best methods to pay up.

Read Also:

- How to Apply for Mortgage Loan in Nigeria with Legal Requirements

- House Mortgage – Meaning, Types, Loans and How it Works

- 10 Important Mortgage Terminology About Home Loan Financing and Banking Terms

- Advantages and Disadvantages of Joint Mortgage Loan for Family Home

- How to Become a Mortgage Loan Officer in Nigeria, Ghana, UK, Canada, USA

- Mortgage Payment Calculator – How to Calculate Your Loan Payments for Free